How much house can I buy with this much money?

Remember when you were in primary school and you’d wait in line at the canteen with a handful of silver coins which probably only amounted to around 65 cents, if that, and you’d walk up to the canteen lady, completely disregarding the growing line of impatient children behind you, and you’d throw down your silvers and ask “what can I buy with this much money?”. Hopeful the canteen lady would take what little finances you had and return with something wonderful like a bag of chocolate buds and a Zooper Dooper. Heck, you might have even got some change back.

Well, this was pretty much how my first appointment went with my local mortgage broker. I was hopeful, albeit completely sure I was going to be laughed at and told to come back when I had over $100,000 saved.

I was unaware of the options available to first home buyers and I was convinced it was going to be impossible to enter the market at all. So, I was delighted when I was able to speak with a professional who laid it all out on the table and talked me through it all.

I didn’t walk out with a home loan right then and there, but I did walk out feeling like I was on the right track as a first home buyer, with the right information and a much clearer view on the options available to me in my financial position.

I covered off some of these options in another article, you can read it here.

The dream ain't over yet

In this article, I want to explore other options available to first home buyers to help make it easier for us to enter the market. This is an area commonly found confusing by FHBs – me included.

Before I started the journey, I’d heard things about stamp duty exemptions and first home buyer grants but to be honest, I never really knew what they meant or if I was eligible for them.

Having conducted a bit of research, I’m happy to share the below information with you – in hopes it will clear the air on what’s what.

First Home Owner's Grant (New Homes) scheme

The First Home Owner’s Grant (FHOG) scheme is a state governments’ initiative to help first home owners achieve their first home dreams sooner. It does require you to be buying or building your new home and depending on your location, there will most likely be a cap on the value.

Whist there are variances from state to state, eligibility criteria to meet before you can apply for the grant generally includes:

•You must be a FHB as a person, not a company or trust.

•If you’re buying with another person, at least one applicant must be a permanent resident or Australian citizen.

•Each applicant must be at least 18 years old.

•You or your spouse cannot have lived in a residential property which you owned from 1 July 2000.

•You or your spouse, partner or co-purchaser may not have claimed the grant previously.

•You must occupy your first home as your principal place of residence within 12 months of the construction or purchase of your home and the minimum period of occupancy is six continuous months.

The grant changes per state, too – you can check all the details on the First Home Owner Grantwebsite. I have taken the liberty of listing these here for you:

NSWIn NSW, the scheme offers a $10,000 grant for the purchase or construction of new homes with the value of a newly constructed property having to be $600,000 or less for it to be eligible. If you are buying land and plan on building a new home or dwelling on that land, then the value must be equal to or less than $750,000.

QLD

In QLD, depending on the date of your contract, you could be eligible to receive $15,000 or $20,000 towards buying or building your new home, if it is valued under $750,000.

VIC

Victoria offer a $10,000 First Home Owner Grant is available to eligible applicants buying or building a new home valued up to $750,000 in metropolitan Melbourne and for applicants in regional Victoria, the grant is $20,000.

ACT

It changes again in ACT, with the grant of $7,000 available to help fund the purchase of a new or substantially renovated home, valued $750,000 or less.

WA

The grant available in Western Australia is $10,000 for those eligible and buying or building a new home. Eligible properties located south of the 26th parallel (of southern latitude) are capped to $750,000, whilst properties north of the 26th parallel are capped to $1 million.

SA

If you’re from South Australia, you can take advantage of up to $15,000 which is available to FHBs for the purchase and construction of new homes valued up to $575,000.

TAS

Like regional Victoria, the grant is $20,000 for FHBs buying a new home, buying a new home off the plan or building a new home. However, this is expected to reduce to $10,000 from 1 July 2020.

NT

A $10,000 grant for FHBs is available to eligible applicants who purchase or construct a new home. No limit applies to the value of the property you buy or build, either!

Transfer Duty (previously known as Stamp Duty) Exemptions

There are several things to factor in when calculating what the transfer duty will be on the property you buy and what exemptions will be for you, in your specific state.

For FHBs though, as part of the First Home Buyer Assistance scheme, we may be exempt from transfer duty on new homes, or eligible for discount. To be eligible for this, you need to be:

•Over 18 and a permanent resident or citizen

•Have never owned a property before

•Have never received a first home owner grant or concession

The best place to find out about these exemptions is either through your mortgage broker, or your state revenue’s websites:

NSWACTSATASNTVICWAQLD

The Federal Government's First Home Loan Deposit Scheme

The Federal Government has announced it will do more to assist us FHBs trying to enter the property market. The good news is, we don’t have to wait too long for this either as it’s expected to come into play from January 2020.

There isn’t a great deal of information about this new FHBs scheme yet, in terms of which big four banks are going to be taking part, however what I have found out, is that it aims to help up to 10,000 first home buyers on low and middle incomes entering the market each year.

Though beware, it is on a first in, best dressed basis and eligibility criteria applies….

The Federal Government announced this scheme in May 2019, just ahead of the election. Under the scheme, the Government will offer loan guarantees.

What does this mean? Well, the Government will guarantee the additional amount needed to reach a deposit of 20% and for the eligible 10,000, they will be exempt from having to pay Lenders Mortgage Insurance (LMI).

So, if you have saved 5% of the purchase price of your property the government will guarantee the remaining 15% of the deposit and whilst you will still need to borrow 95%, you will be able to avoid lenders mortgage insurance (LMI).

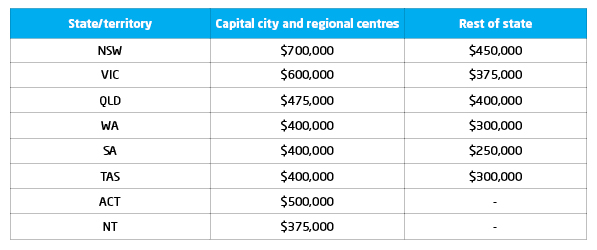

So, if you’re a single earning less than $125,000 a year or a couple earning a combined income of less than $200,000 a year then this scheme could become available to you come January 2020. However, the guarantees do come with property price caps as per state/territory and whether you’re buying in a capital city/regional centre or the rest of the state.

For example:

If you’re buying in NSW, specifically Sydney, then the price cap is $700,000. However, if you’re looking to purchase elsewhere in the state, where the median house price is less, the cap will be $450,000.

You can see more in the table below:

(Sourced from: abc.net.au)

The full details of the scheme still haven’t been announced yet, but we will sure to update this article when it has.

As always, if you want to speak with a professional about this, reach out to your local mortgage broker for more information and assistance with applying.

First Home Super Saver Scheme (FHSS)

If you’re still slugging it out trying to save even just a 5% deposit and you feel like you’re not getting anywhere, then this could be a scheme for you. The FHSS was essentially introduced to allow FHBs to save money inside their superannuation fund for a deposit toward a first home. It works by tapping into superannuation’s tax breaks to give your deposit a bit of a boost.

You can make voluntary contributions to a maximum of $15,000 in any one financial year, and up to a maximum total of $30,000 in total, to your super and withdraw this amount, plus earnings, less tax. So, because you’re saving through super, you pay less tax than saving outside of super, meaning you can save your deposit more quickly.

A great fact sheet by First State Super shows just how your contributions work compared to saving outside of super. You can view it, here.

Talk to your mortgage broker today

If you’re ready to learn more about what’s available to you as a first home buyer, and you haven’t made an appointment with a mortgage broker yet, you can use our helpful Find a Mortgage Broker search engine, which will help you find your local ALI-authorised broker, ready to help you purchase your home and protect it.

Click here.

Stay tuned for our next article

There is still much to discuss about the home buying process. Stay tuned for our next article!

About Emma Flanagan

Emma is the Senior Marketing and Communications executive at ALI Group. After completing a Bachelor of Communication with a Major in Journalism, Emma spent a couple of years living, travelling and working abroad before making her way home to Australia. Now, with firm roots back in her home town of the Central Coast in NSW, her and her husband just bought their very first home with the help of their mortgage broker. Now, Emma is here to help FHBs just like her by providing informative and educational content and to keep them abreast of what’s what when it comes to buying, refinancing and protecting themselves and their family from financial hardship.