There’s a huge underinsurance problem in Australia

When it comes to Australian’s attitudes towards life insurance, a recent Zurich study found that 30% of respondents were not willing to pay a fee to receive life insurance advice, while only 8% of consumers were willing to pay a fee of more than $1,000 to see a financial advisor, and 0% said they were willing to pay $2,000 or more1.

Preferred channel for finance

Nearly 60% (59.1%) of residential home loans are settled by mortgage brokers – this is a sizeable chunk of the population. If they don’t speak to their mortgage broker about their Plan B, who will they speak to?2

They are a borrowers trusted adviser

In a survey commissioned by ALI3, expert advice was the number one reason clients chose to use a mortgage broker. Part of that expert advice is educating clients about risk and providing a solution on how to help reduce its impact.

Because misfortune doesn’t discriminate

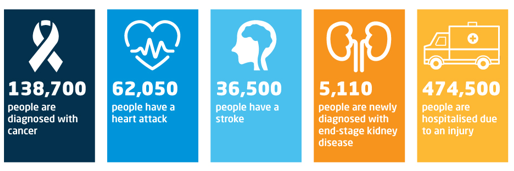

In Australia this is what an average year looks like4.

It’s also reported, more than one in four Aussie’s (26%) have been through a redundancy at some point in their working lives4 . Read more about how the ‘She’ll be right’ attitude can devalue more than your client’s health.

Great return for a 10-minute discussion

You can grow your income while deepening your client connection, which can also lead to more referrals.

The offer is simple

There’s no awkward health questions. It’s all arranged online and integrated within leading aggregator CRM systems.

Service and support you can count on

You’ll have a dedicated BDM for training, coaching and support. We also have a specialist call centre for brokers and policyholders. And, you’ll enjoy a portal with useful tools and collateral.

Don’t just take out word for it, hear from your peers here. Or, let us know you're interested.

1 https://www.ifa.com.au/risk/26561-major-adviser-client-disconnect-on-risk-advice-research-finds

2 https://www.mfaa.com.au/news/mortgage-broker-market-share-surges-to-a-record-59.1-per-cent

3 ALI Group CoreData Survey May 2018

4 Australia’s health 2018: in brief report [accessed at:https://www.aihw.gov.au/getmedia/fe037cf1-0cd0-4663-a8c0-67cd09b1f30c/aihw-aus-222.pdf.aspx?inline=true]

5 Seek, Career Advice [accessed at: https://www.seek.com.au/career-advice/honest-truth-about-redundancy]