CoreData Survey Results

CoreData survey records above industry Net Promoter Score for ALI Group

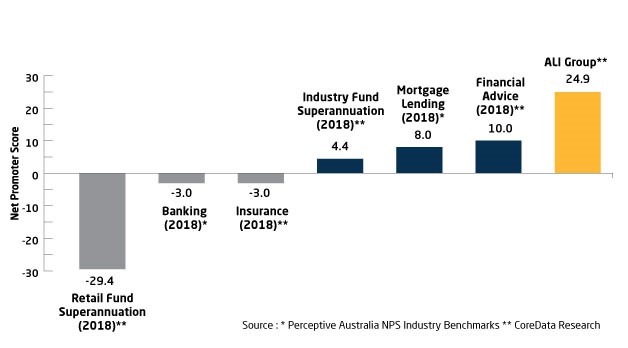

ALI Group is proud to announce an industry leading Net Promoter Score (NPS) of 24.9 from its policyholders.

The independently run survey by CoreData

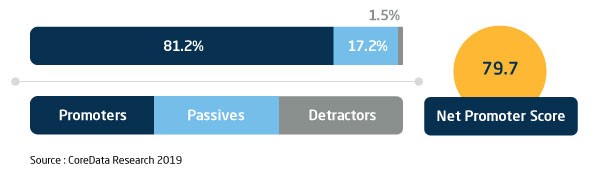

went out to a sample of almost 9,000 policyholders as well as ALI authorised brokers who recorded an even more impressive NPS score of 79.7

CoreData Research is a global specialist financial services research and strategy consultancy. Simon Elwig, Head of Lending at CoreData says, “We have been doing NPS surveys for the financial services industry for a number of years and an end customer score of 24.9 is very impressive when compared to last years broader Insurance score of negative 3 or financial planning at 10. Similarly, a broker score of 79.7 is one of the highest scores we have seen in the third-party space. These scores highlight that ALI policy holders and brokers highly value the product and service being provided.”

ALI Group CEO, Huy Truong says, “The high results from the policyholders should feel like a win for brokers as much as it is for us at ALI Group because it shows us how Australian home and property buyers feel about the protection they were offered by their broker, long after settlement. The high score is testament to how Australians value having the peace of mind that if the unexpected were to happen, they have a level of cover in place to help them through financial hardship. Brokers will be reassured to see how this creates and sustains strong customer relationships. The ALI team are justifiably proud of these results from CoreData. It provides independent verification that we are providing an insurance solution (information, product and ongoing service) which home-buyers really value.

We are equally pleased with the broker score given they are also our partners. The investment we make in broker training and education is arguably the largest of any non-lender in the industry and it’s great to see that investment being valued and making a difference. More broadly though, these results really highlight how loan and mortgage protection is a critical part of a mortgage broker’s service to home and property buyers.”

The results from policyholders were driven by loan protection’s affordability and ALI Group being easy to deal with. Real policyholder quotes were recorded in the results, with home buyers as young as 23-years-old recognising the benefits, stating “Loan protection is for those ‘what do I do now’ moments, a fall back, a sense of security knowing someone has your back” (23, Male, Western Australia).

ALI believe their continued focus on creating strong customer experiences, with their on-boarding calls and welcome video helping policyholders to truly understand the product PDS are just some of the initiatives which may have contributed to the results.

The broker survey asked brokers specific questions ranging from their experience with ALI’s head office support, the value of the relationship their dedicated business development manager provided, to their overall experience with the ALI Group loan protection product.

In a breakdown of the results, it showed that ALI authorised brokers have a 98% satisfaction rate in terms of the product being a simple and easy process as well as the knowledge of BDM’s and the confidence they instilled about the loan protection product and offer. Product suitability and head office support both returned a high 97% satisfaction rate from authorised brokers.

ALI Group will be using the information and the results from the survey to continue meeting the needs of their authorised brokers and their policyholders to ensure quality service and customer experiences.

About ALI Group

ALI Group is a leading provider of loan and mortgage protection to Australian home and property buyers.

Since 2003 we've protected close to 200,000 Australians with over $53 billion in cover.

Our mission is to protect Australian home and property buyers from financial hardship. We have a close affiliation with the mortgage broking industry – and more than 4,500 brokers nationwide are authorised to offer our products.

About CoreData

CoreData Research is a global specialist financial services research and strategy consultancy, founded in 2002 and headquartered in Australia, with operations in Sydney, Perth, London, Boston and Manila.

It provides clients with bespoke and syndicated research services through a variety of data collection strategies and methodologies, along with consulting and research, database hosting and outsourcing services.

CoreData provides both business-to-business and business to-consumer research, while the group’s offering includes market intelligence, guidance on strategic positioning, methods for developing new business, advice on operational marketing and other consulting services.

For more information

For more information and media interviews:

Emma Flanagan

Marketing Communications Executive

[email protected]

PH: 02 8224 2505